Evaluating June

June was the first full calendar month that the portfolio was live. Let's see how the real-life results compare to the backtested results. The figure below shows the backtested results, using the portfolio weights I chose at the end of May. The blue part of the curve shows what was known on May 31st, the red part shows the "walk-forward" results for June. Remember, these curves assume daily rebalancing (not very realistic), no transaction costs, but they do take into account slippage for extreme-os. We can see that the red part (walk-forward) is not really different from the earlier backtested results, which is good. Obviously it was a losing month, with some drawdown, but these have occurred previously in the blue part of the curve as well.

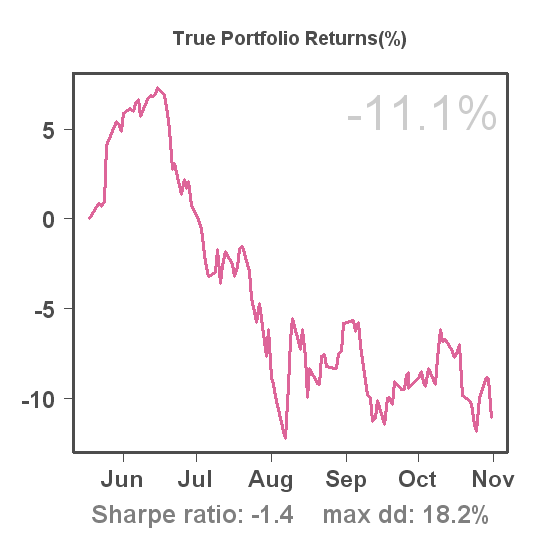

The next question is: How did our real-life results compare to the June walk-forward test results (red part of the curve)? That is shown in the figure below. Due to the hedge (which is neither included in the backtest nor the walk-forward test), we can see that volatility is lower in the real life results. At the end of the month the curves nicely come together, but we have to remember that without the hedge real-life returns would have been worse (as expected) than the walk-forward returns. This is, again, because the latter do not take into account transaction cost and assume daily rebalancing.

1 comment:

This is 'unfolding' as an interesting study. I am new to these parts, so with regards to 'backtesting' I have no concept. My initial thoughts are (a) "How can these be in ANY way realistic." (b) "So there are systems (software) that will allow for you to input parameters - and out comes (realistic) expected results?" (What I mean is that there is SOME correlation?)

It's been one month and as you say there are some differences - but to start and end up the same AND with a general trend correlation is "eye-opening?".

Looking forward to seeing more results unfold, ST.Ga

Post a Comment