Weekend Trader Rolling Alpha and Beta

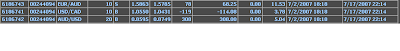

This post will be similar to the recent one on Trend Plays #1, but with results shown for Weekend Trader:

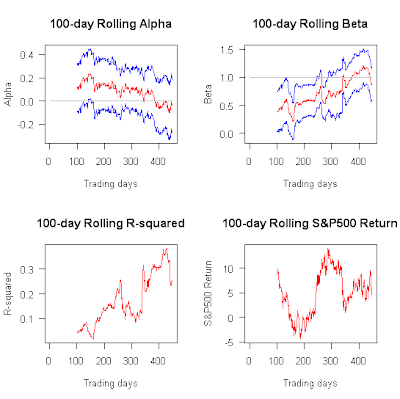

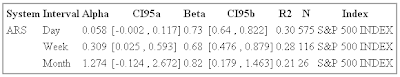

Things don't move in the right direction for Weekend Trader currently, which is unfortunate. Alpha shows a slow but steady decline from 0.12% per day for the first 100 trading days to -0.04% for the most recent 100 trading days. At the same time beta has seen a steady increase from 0.38 to 0.87. Or, in other words, for the last 100 trading days, the system pretty much had the same volatility as the S&P500 with no excess returns. I don't know the reason behind these trends, but I would like to see them reverse (i.e. increasing alpha and decreasing beta). The fact that my portfolio optimizer started to give smaller weight to Weekend Trader in the portfolio is consistent with these results, and when the trend would reverse I'd expect to see the optimal portfolio weight for Weekend Trader go up again.

I checked whether the trend was statistically significant (using the same model as discussed for Trend Plays #1), but it wasn't. (tau = -0.00044% per day, with standard error of 0.%, which means it's not statistically different from zero at both the 95% and 90% level).

A possible explanation for the declining alpha could be that as more people started to trade the system over time, the increase in order size started to affect the entries and exits of the system. Therefore, I estimated the rolling alphas and betas again, assuming that all transactions did not take place on Monday at the open (which is the official entry/exit point the vendor uses), but instead on Monday at the close:

As we can see, no clear difference. Hence we can rule out that explanation.